KCC scheme was first introduced during the year 1998 for farmers on the basis of their holdings by the banks for purchase of agriculture inputs such as seeds, fertilizers, pesticides, etc. and to draw cash for their production needs. The scheme was further extended for the investment credit requirement of farmers viz. allied and non-farm activities in the year 2004.

The State Bank of India’s (SBI) Kisan Credit Card (KCC) provides timely and adequate credit to farmers to meet their cultivation expenses. It also addresses farmers’ contingency expenses and expenses related to ancillary activities via a simple procedure allowing borrowers to avail loans based on their needs.

Here is a look at the features, benefits, interest rate, eligibility, and process of applying for SBI’s Kisan Credit Card.

Features and benefits

- KCC will be like a revolving cash credit account

- Credit balance in the account, if any, will fetch savings bank’s interest rate

- Tenure: 5 years, with a 10% annual increase in limit every year subject to annual review

- Interest Subvention: 3% interest subvention for prompt borrowers up to Rs 3 lakh

- Repayment: The repayment period as per the crop period (short/long) and marketing period for the crop

- Allotment of RuPay cards for all eligible ..

Accidental insurance of Rs 1 lakh for Rupay Card Holders if the card is activated once in 45 days

Eligibility

- All the farmers-individuals/joint borrowers who are owner cultivators

- Tenant farmers, oral lessees, ShareCroppers, etc.

- SHGs or Joint Liability Groups of farmers including tenant farmers, sharecroppers, etc.

Interest rate

- Up to Rs 3 lakh: 7%

- Above Rs 3 lakh: As applicable from time to time

Insurance

KCC borrowers below 70 years of age are covered under Personal Accident Insurance Scheme (PAIS)

Eligible crops are covered under Pradhan Mantri Fasal Bima Yojna (PMFBY)

Security

- Primary: Hypothecation of Crop.

- Collateral: Mortgage/charge over Agriculture land (Collateral security is waived for:

- KCC limit of up to Rs 1.6 lakh.

- Under Tie-up: KCC limit up to Rs 3 lakh

Banks that provide Kisan Credit Cards

Kisan Credit Card is offered by many public sector banks, co-operative banks and rural banks in India. Some of them are:

Bank of India (BOI)

Axis bank Kisan credit card

National Payments Corporation of India (NPCI)

Industrial Development Bank of India (IDBI)

NABARD

How to apply for SBI Kisan Credit Card

- Download the application form from SBI – https://sbi.co.in/documents/14463/22577/application+form.pdf/24a2171c-9ab5-a4de-08ef-7a5891525cfe

- Farmers can also directly visit SBI branch and ask for KCC application form

- Fill in the required details and submit at the branch

- The bank will review the review the application, verify applicant’s details and sanction the card

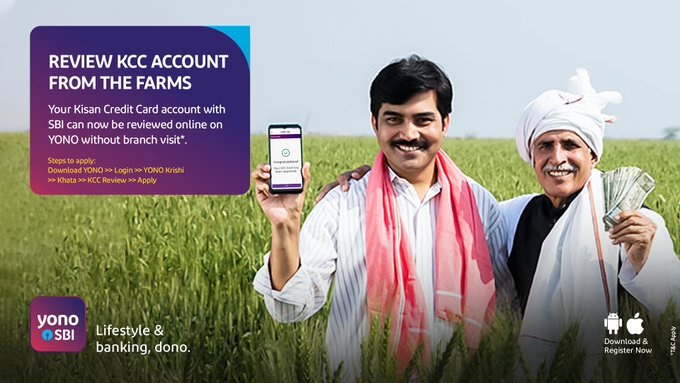

How to review KCC via YONO

- Log-in to YONO SBI

- Click on YONO Krishi

- Click on Khata

- Click on Kisan Credit Card

- All you need to do is: Confirm personal details; Confirm land details; Confirm crop details

- Submit application

Documents

- Address and Identity Proof: Aadhaar card, PAN card, Voter ID, driving license, etc. (any one)

- Documents of the agricultural land

- Applicant’s recent passport size photograph

- Issuer banks may also ask to submit security Post Dated Cheque